An aerial view of Silicon Valley in the 1970s

Breakthrough Energy Ventures

Development

The best way to build technologies is with tech companies, and for almost 50 years, the surest way to build tech companies has been with venture capital .

The first venture firm signed a lease on Silicon Valley’s Sand Hill Road in 1972, and ever since, the playbook for building a very big technology company very quickly has followed four steps: identify a unique way to solve a large problem using technology; secure a venture investment; use the money to hire smart people; and build a successful company.

But there’s always been an unwritten caveat to these instructions: they don’t apply if the company you’re building has something to do with the Earth’s changing climate.

Venture capital has always had a climate problem .

The San Francisco-Oakland Bay Bridge lit up a night

Unlike VC and software, or VC and search engines, or VC and social media, VC and climate tech never fit very well together—partially because of a skills gap. Climate tech is a relatively new field, and there aren’t many people with both a hard science background and expertise in building startups.

Successful entrepreneurs often became venture capitalists while chemists and biologists became, well, chemists and biologists, leaving an absence of people who might make informed investments in nuclear fission or carbon-free cement.

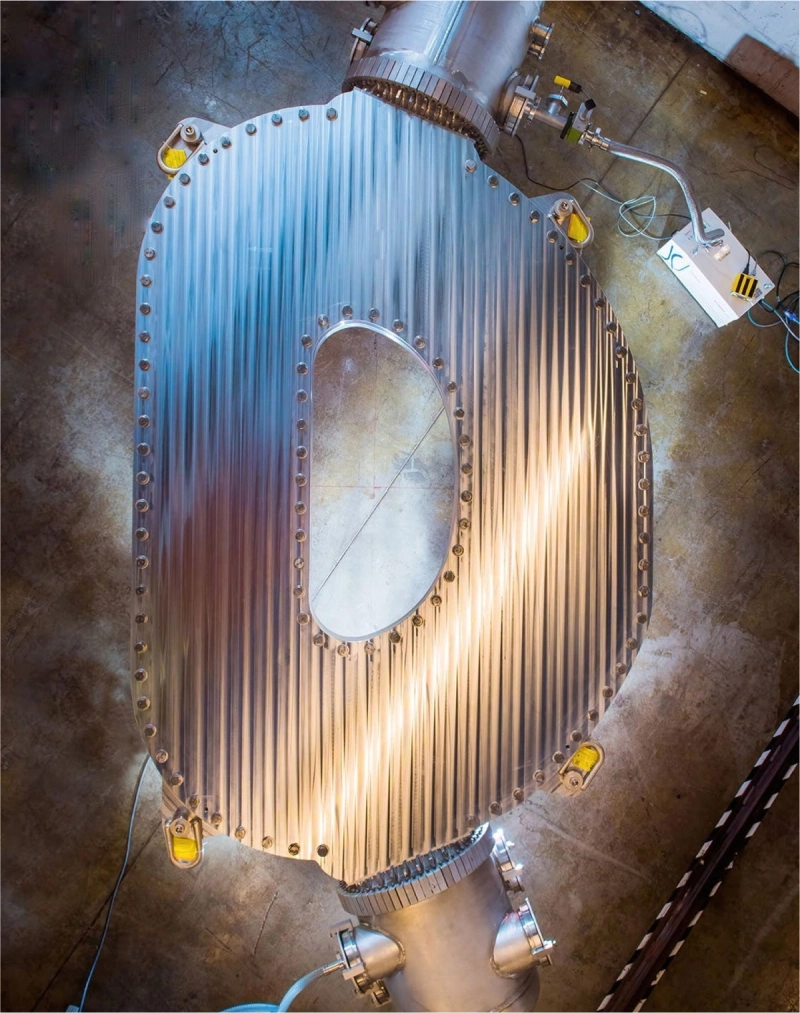

A fusion magnet manufactured by Commonwealth Fusion Systems using a new high-temperature superconductor

Timing was another square peg in a round hole. Most venture capital firms invest in startups hoping they’ll make their money back within a decade, a reasonable expectation when you’re investing in software. Roughly twenty-six months elapsed between Microsoft’s hiring of its first Windows programmer and when the first Windows 1.0 floppy disks hit the shelves.

But fusion power plants are not lines of code. Nor are carbon-free steel factories or advanced car batteries. These technologies can take years, even decades, to translate from cutting-edge science to deployable and scalable solutions.

Climate tech is also typically “tough tech” — applications of science and technology to the world's biggest problems — and has similar structural obstacles to getting off the ground. Namely, pretty slim margins, which are usually not compatible with a VC firm seeking huge returns for a small slice of their portfolio.

These kinds of tech also have fewer intermediate checkpoints to make sure they actually work. Think of an industry like pharmaceuticals, which has a standard progression of four different trial phases — there’s nothing really comparable for tough tech. It’s often difficult to tell how well a company will do until it’s literally on the market.

ZeroAvia HyperTruck Ground Rig Tests It's HyperCore Motor Technology

For all these reasons, by the mid-2010s, Bill Gates and Breakthrough Energy’s founding team realized that, if climate tech was to benefit from the company-building, scaling power of VC, then it would need to be a pretty different kind of VC.

It would have to be a VC operation that was built for the specific purpose of supporting decarbonization technologies, which meant it would have to be far more patient, and more technical.

Any VC firm investing in climate would also need to get comfortable taking enormous risks and be prepared to deal with the policy and capital intensity specific to climate tech.

A cement blocked created using Brimstone's carbon-negative process

Of course, all VC firms are comfortable with some measure of risk. They recognize that only a small fraction of their portfolio companies will return a profit. But climate venture capital is different from the rest in one important respect: There’s a big invisible countdown clock hanging over its work like a specter. Investors and their startup companies aren’t trying to meet an artificial financial deadline; they’re racing against a real climate deadline, as more and more greenhouse gas (GHG) emissions are released into the Earth’s atmosphere.

Given the narrow window we have to solve climate change, it doesn’t make sense to invest resources in a company that will abate a small amount of GHG emissions — even if their technology is a surefire bet. We need to make big (albeit well-informed) bets.

At Breakthrough Energy Ventures, we concluded that any startup worthy of investment needed a conceivable pathway to reducing 500 megatons per year of GHG emissions — roughly one percent of all global annual emissions.

Six years later, Breakthrough Energy Ventures has invested nearly $2 billion in over 100 such companies . It’s still too early to measure how much emissions these companies, individually or collectively, have abated. (We plan to include those metrics in future versions of this report). But much of the anecdotal evidence we have shows that our model is working.

Antora's technology producing thermophotovoltaic cells

Case Study: Antora Energy

When Breakthrough Energy Ventures first met with Antora , the company employed 15 people and had just moved out of their first office at Lawrence Berkeley National Laboratory.

“Office,” in fact, was a generous term.

Antora was working out of a trailer.

Andrew Ponec, Justin Briggs, and David Bierman had started Antora with a single question: What is the most important solution to climate change that no one else is building? Their answer: a modular thermal battery capable of outputting zero-emissions heat and power to decarbonize manufacturing, the single largest source of global emissions.

At the time, Antora had recently broken the world record for efficiency in thermophotovoltaics—a groundbreaking technology for converting heat to power. And the scrappy team had built a prototype that demonstrated the basic operational principles of their thermal battery, receiving seed funding from the U.S. Department of Energy’s Advanced Research Projects-Energy (ARPA-E) , the Office of Industrial Decarbonization and Energy Efficiency (IEDO), the National Science Foundation (NSF), and the California Energy Commission (CEC).

Antora's thermal energy storage site in Fresno, California

It was immediately clear to the BEV team that Antora had a powerful idea for a rapidly scalable product, an enormous market opportunity to decarbonize industrial heat and power, and an exceptional team with world-class technical expertise. What they needed was private capital and support to take their game-changing idea from a prototype to a commercial-ready product. That is what Breakthrough Energy Ventures delivered, co-leading Antora’s Series A and bringing total funding up to $50 million.

Antora is electrifying heavy industry with zero-carbon heat and power

BEV’s Christina Karapataki, who joined Antora’s board, and Sila Kiliccote, a former startup CEO, who joined as a board observer, are now trusted partners to Andrew, Justin, and David on all aspects of the business, including product development and the commercial roadmap. They have connected Antora with major renewable power suppliers, marquee customers, and critical commercial and financial partners. And the robust policy and communications support that Breakthrough offers has helped Antora navigate the intricacies of the energy and industrial sectors.

Two years after leading Antora’s Series A, the catalytic impact of our investment is clear. This fall, Antora launched its first commercial-scale thermal battery at an industrial site outside Fresno, California, which Bloomberg called “a major step toward its goal of weaning heavy industry off fossil fuels.” With BEV’s support, Antora is now ready to scale. They recently opened a thermal battery manufacturing facility in San Jose, California that will have its first battery modules rolling off the line in 2024 to serve major industrial decarbonization projects. And they have additional customers lined up for a proven product that’s poised to decarbonize industrial sites across the United States and around the world.

BEV's Eric Toone delivers remarks at the Breakthrough Energy Summit

What’s next for BEV?

What are the kinds of companies the climate needs built next?

Last year, at Breakthrough Energy’s inaugural summit, Eric Toone, BE’s Chief Technology Officer, laid out three categories of problems that need addressing:

The challenges we didn’t see in in 2015, when we were founded;

The challenges we did anticipate, but still haven’t solved;

The challenges that didn’t exist in 2015, but now do because the world has changed.

Those questions are informing the future of Breakthrough Energy’s work at this development stage, as we look at funding new early-stage companies — and continue to help the ones already in our portfolio.

Breakthrough Energy Catalyst

Deployment

Imagine you’re an innovator working on emerging climate technologies. You pour your blood, sweat, and tears into developing the technology. Once you get it to work, investors will surely be knocking on your door. Right?

Unfortunately, it’s not that simple.

For a new technology to draw investors, it needs to be “derisked.” That means more than just proving the technology can work. It means proving it can work at scale — and be cost competitive with fossil fuel alternatives.

Scroll to navigate to

next section

Click to navigate to

next section