Development

Patient Capital ≠ Lazy Capital

Climate tech has become one of VC’s most attractive sectors. Now, the money needs to be matched by elbow grease.

A decade ago, you could’ve searched the Silicon Valley phone book (those still existed) and turned up only a handful of venture capitalists willing to invest in climate tech.

Some didn’t know what “climate tech” was. Those who did know thought it was “too risky.” Investments in the early 2000s, when the area was hotter, hadn’t panned out.

Today, things have changed. Investors know what climate tech is—and many want in.

Breakthrough Energy Ventures (BEV) is the venture capital arm of Breakthrough Energy. Over the past nine years, we’ve invested $3.5+ billion into over 110 climate tech companies. We’re constantly learning more about these technologies and markets. So, we’re always adjusting our investment strategy.

Since last year’s report, we’ve been focused on this question:

- How can our portfolio companies collaborate more—both with larger companies who may benefit from their technology and with investors who provide different skillsets?

This, we’re finding, can be a game-changer for our portfolio companies (and all climate technologies). It’s by finding their place in the larger story about climate change being told across all parts of the economy—from governments, to investors, to large corporations.

Collaboration

Capital is always critical, but so many fledgling companies could benefit even more from a quality partnership with an engaged investor. Someone who doesn’t just write a check, but checks in. Someone who offers support and expertise during the inevitable lows every early-stage company endures. Someone who doesn’t simply attend monthly calls and quarterly board meetings, but jumps in and helps problem solve.

These companies need a true partner. And a true partner sometimes has battle scars. A true partner can cite instances of when they joined their companies in the foxhole and helped them find a way out.

Of course, it’s easy to say all this in theory. But our Ventures team is showing how it’s done in practice.

Take fusion technology, for example.We often call fusion the holy grail of climate tech because of its potential to provide energy abundance for the world over. But it’s also deeply complex—a fact that can repel many potential investors who don’t want to cut a check for something they don’t understand.

Instead of leaving this educational heavy lifting to our portfolio companies, BEV drafted a 100+ page technical diligence report that could be shared openly with investors.

This report tackled two questions in painstaking detail:

- 01If this technology works, will it matter? (In fusion’s case, the answer is obvious: Yes!)

- 02Even if this technology, is it economically feasible? (Perhaps).

The 100-page report dove deep into the economics of building a fusion reactor, understanding that the final cost would be somewhere between the current cost and the cost of the raw materials. It focused on a company aiming to upend those economics with a new magnet.

With fusion, it’s magnets—very advanced, superconducting magnets—that contain the reaction and keep it going. Currently, these magnets are enormous. In some cases, they’re 54 feet tall, 12 feet wide, and weigh 1,000 tons.

The magnet’s size is what provides the tremendous magnetic force required for fusion (roughly 280,000 times Earth’s magnetic field).

The size is also what makes it costly.

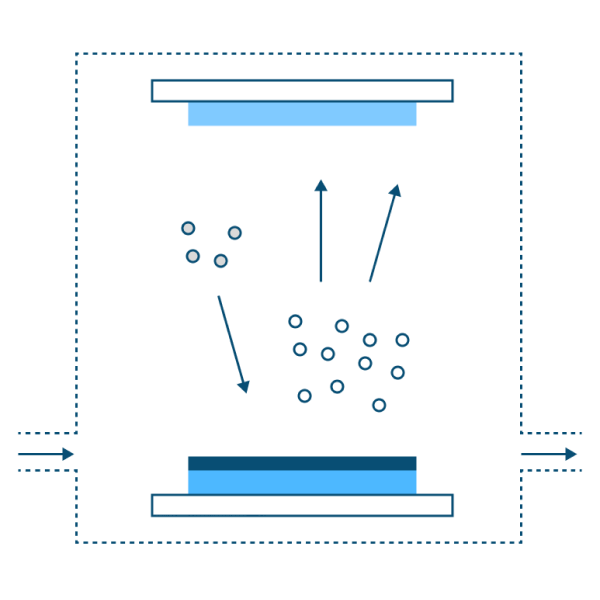

If engineers could pack the same amount of magnetic force into a much smaller magnet, the economic viability of the technology would be more likely. Which is why the report looked at new methods for building magnets using thin-film deposition technology, where the superconducting material is applied atom by atom.

The precision could potentially let engineers build fusion reactors at 1/50th the size.

Is the future of global energy through super-small, super-powerful magnets?

It’s a thesis worth investigating—for at least 100 pages. Because with climate tech, the answers to fundamental questions are rarely black and white. Green contains many shades of gray. And these reports help investors see that grayness in all its complexity.

We heard from nearly a dozen major investors that our work was transformative in their decision to invest in the fusion space.

Priming the Pump

This proactive collaboration is especially important in the early stages of a company’s life. Right now, a lot of investors rely on a rigid set of criteria. If they have 10 boxes and the company they’re evaluating only checks five, they move on. They’re not willing to risk a $15 million investment on a technology that doesn’t meet their checklist.

But by waiting, venture firms are only hurting their own bottom lines. Either they’re never going to see anything worthwhile come out the pipeline, or they’re going to make an investment in a firm that’s not ready to scale.

That’s where we, as investors, need to change our way of thinking.

Behind the Investment Curtain

30 MinAt Breakthrough, we help innovators at all stages of the company-building process. Our Discovery program brings the best ideas out of the lab. Our Deployment program helps companies scale and go to market. But it's Ventures coming in at the development stage that helps nascent companies turn their technology into a real product. This critical Development stage is where we can expand our reach.

Instead of waiting for perfect companies to emerge fully formed and check all of our boxes, investors should be more proactive about jumping in early, with a smaller dollar amount, to help early-stage companies work out the kinks and get to a place where they can attract a bigger investment. In other words, they need to prime the pump.

This approach won’t just result in better companies and stronger partnerships. It could also help increase diversity in the entrepreneurship space by providing support for innovators who are typically overlooked by venture investors.

A few of our external partners and co-investors are already engaged in this critical work alongside Breakthrough. Venture capitalists like the legendary John Doerr and Vinod Khosla have been doing this work for years, partnering closely with early-stage companies to make sure they’re ready for commercialization. These VCs and their firms have a deep understanding of the unique challenges of climate technology.

Video

Vinod Khosla's Advice to Climate InvestorsThen, there are newer firms that were built from scratch to support climate tech, such as Prelude Ventures. Breakthrough works closely with their partners, including Gabriel Kra and Nat and Laura Simmons.

Another example of these climate-first VCs is Katie Rae and her team at Engine Ventures, an MIT spin-off investing in ”Tough Tech” founders in climate, health and advanced systems. They provide capital, hands-on expertise, and access to an extensive network spanning academia, industry, and government. These networks are especially vital for climate tech, which, unlike the traditional tech sector, doesn’t have a universal hub like Silicon Valley.

It’s also important to help promising young ventures reach escape velocity. In June, we closed our Select Fund I, which will invest in roughly 15 to 20 climate startups that have overcome their early hurdles. Their technology was proven, and they found a market for it. In some cases, they’re already making money. And they can reach the next level of deployment with extra capital and assistance.

Uncertainty

Ultimately, one of the main hurdles to this kind of investing and partnership is not risk, but uncertainty. Investors are creatures of habit. They’re not eager to veer from their tried-and-true formula. But by grasping the opportunity to get in early and partner in the right way, they’ll realize there’s a lot less uncertainty than they think. Because by getting in before anyone else and using their expertise to guide a company forward, they’re helping build something they’ll understand better than the rest of the market.

And that’s a huge investment opportunity.So whether you’re a government setting the guidelines for a grant, a large company defining its requirements for a deal, a lender, an investor, or an incubator, don’t be constrained by pre-set criteria. Don’t be handcuffed by uncertainty. Go early, use your expertise, and be a true partner. Breakthrough will be right there alongside you.